Bryan Bottarelli

Head Trade Tactician, The War Room

If you’re like most investors, you’re intrigued by the immense profit potential of options trading.

You’ve heard all the success stories…

And you want a piece of the action.

But at the same time, you’re also intimidated by the terminology, unsure of the risks involved and skeptical of your own ability.

As a result, you’ve never fully embraced options trading.

Well… starting today, we’re going to change that.

In this simple, elegant, and powerful guidebook, my partner Karim will give you a complete, one-stop introduction to the options world.

You’ll learn the ins and outs of his top winning strategies for beginners.

You’ll understand how our trading methods can tilt the odds in your favor.

And most importantly, by the time you finish, you’ll realize that you can now – finally – begin to harness the incredible profit potential of options trading.

It all begins with understanding the strategies that have consistently worked for us – year after year.

We call them…

5 Winning Options Strategies for Beginners.

Knowledge is power – and when you understand how options work, and then use that understanding to implement these strategies, you’ll take that all-important first step toward creating a wealth-generating tool that’ll last a lifetime.

It’s an incredibly empowering feeling, knowing that you can wake up on any given market day and make yourself tens of thousands trading options – with most of the profits coming before your first coffee refill.

Does that sound good to you? Damn right it does.

So with that… let’s get started.

Karim Rahemtulla

Head Fundamental Tactician, The War Room

I’ll now hand things over to Karim, who will begin by showing you one of the most powerful tools he uses every single day.

It’s something he calls “cluster buying.”

Karim, take it away…

Winning Strategy No. 1: The Incredible Predictive Power of “Cluster Buying”

Thanks, Bryan.

I’d like to start off by showing you why “cluster buying” is such a powerful – and profitable – predictive tool.

One of the best examples begins in late March of 2020.

March 25, to be exact.

That’s the day I noticed a heavy amount of insider buying was occurring on Eastman Kodak (NYSE: KODK).

After detecting this, I posted this message to my readers…

❖ Karim R. 3/25/2020 at 2:19:37 pm

KODK – lots of insider buying on this patent play

Yes, that’s right. I was talking about the old, outdated, left-for-dead camera film company.

For 20 years, shares of Kodak were a losing investment.

It was dead money. The stock went nowhere but down.

But then – for some strange reason – insiders were suddenly buying KODK shares.

Not only that, but the buying was coming in groupings – or “clusters,” as I call them.

In other words, it wasn’t one rogue KODK buy. It was a number of different insiders – all buying KODK simultaneously.

When I see this, I know something is happening behind the scenes.

It’s one of the best “tells” on Wall Street.

Insiders have information – and they’re buying the stock.

What exactly is that information? Nobody knows. But what we DO know is…something is in the works, and the stock could soon pop.

And then, in late July, the news hit…

Kodak was loaned $765 million by the U.S. government to produce drugs stateside.

And then the president got in on the action and mentioned the deal favorably.

That trigger, combined with a small float of trading shares and lots of media coverage, allowed an upside move on KODK that will go down in history!

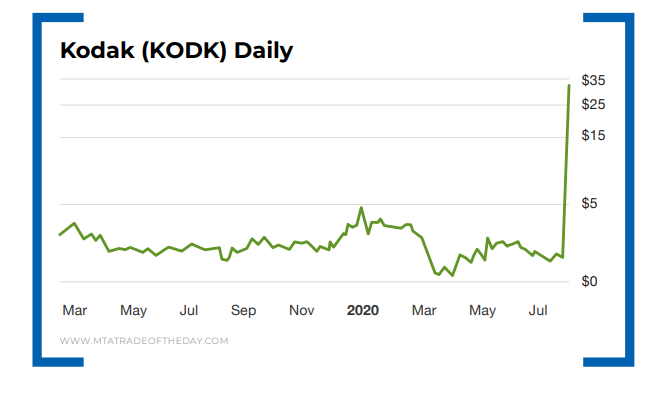

If you didn’t notice, Kodak traded around $2.50 on July 27.

And by July 28, it had moved to more than $50 in intraday trading.

It’s a 2,000% move.

That type of move doesn’t come along very often.

Look at this chart – it’s parabolic!

The executives said that the deal was made a week before. Maybe so. But the groundwork for the deal was laid months before, in my opinion. You can’t just turn a faucet on and say you’ll make drugs.

Maybe that’s why the executives were loading up on shares in March after the crash in the market. Good call, right?

If you were a War Room member as far back as March, you would have been tipped off to this move a month ahead of time.

Now, I admit…

There’s some science behind insider buying, which I’ll reveal to you today.

In many cases, someone does know before something is going to happen. In fact, they know months before something happens, and they don’t just sit on the information. They buy stock with the information, and then they wait patiently for the news to come out – news that they know, most of the time, will come out.

It sounds illegal, doesn’t it? Too good to be true?

It’s not. It’s perfectly legal, and it happens every single day.

If you know where to look, you too can be privy to this type of trading information.

It’s called insider trading. But it’s the legal type.

Following this action is what I specialize in. When a company insider buys shares of their company, they must, by law, report the purchase within a couple of days. That’s one of the “tells” that I use to decide whether the opportunity is worth taking.

After all, most insiders buy for one reason: They know something good is coming down the pike.

When an insider buys because they know something is going to happen, they may not know the exact date it will happen, but they don’t care.

That’s because they know the shares bought are going to scream higher whenever that announcement or event occurs.

Here’s My Formula for Detecting Cluster Buying

What I look for is that first insider buying – and buying in size.

This means they are buying thousands upon thousands of shares on the open market with real money.

This real money has to be in the tens of thousands, if not hundreds of thousands, of dollars.

They can’t be any insider, either. They have to be a high-ranking executive at the company, not a director. They’ve got to earn their money.

The next thing I look for is at least two more executives buying shares on the open market, chronologically – again with size and at market prices, and preferably at higher prices.

In other words, I look for a cluster of insiders, all buying.

Then I want to see some director buys.

All in all, I want to see at least five insiders buy shares in size before I look at the company.

If there are only three or four insiders buying, I want a lot of size and executive participation.

Sometimes the underlying company is not doing well and is a turnaround candidate. This is the most dangerous type of insider buy, and I will note that the buy is very speculative. In this case, the returns can be phenomenal, but so can the risk. It’s speculative, which means you don’t buy very much!

Other times I’ll look at companies in the healthcare or biotech sectors. When insiders buy here, it’s usually because they have good information from clinical trials long before the FDA or the public knows about the trial data.

While not as speculative, these types of insider trades do hinge on the final outcome of a trial; hence, they do carry more-than-average risk.

There might be situations where there are massive buys by insiders that are far bigger than the norm – buys that are in the millions of dollars, for example. But those buys are by shareholders who already own a large chunk of stock. This type of buying, while attractive, also makes me wary. These are long-term investors – value investors – who can wait years.

I am not interested in waiting years. Most insider trades that meet the tests I described above come to fruition in a year or less. Those are the ones I want to focus on. And those are the cluster buys that typically lead to tremendous gains.

Below, I’ll tell you exactly how to get my cluster buying notices – in real time.

I post them – as they happen – inside The War Room.

And as you just saw with the 2,000% pop in KODK, this information could make you rich. Very rich.

But before getting into how to join us inside The War Room, let’s continue with our options trading guidebook…

Winning Strategy No. 2: The No-Nonsense Conversation That Takes Place With Every Options Trade You Make

Let’s start from the beginning…

What Are Options?

An option is an investment that gives you the right (but not the obligation) to buy or sell a specific security at an agreed-upon price within a set period of time.

Every option is linked to and identified by a specific stock (or, in some cases, an entire index of stocks – you can buy options on the S&P 500, for instance).

Options come in two standard varieties: calls and puts. And options trade in lots of 100 shares (called contracts).

❖ One call option gives you the right (but not the obligation) to buy 100 shares of a particular underlying stock at a specific price (the exercise price or strike price) before a specified date in the future (the expiration date).

❖ One put option conveys the right (but not the obligation) to sell 100 shares of a stock at the strike price by the time the put option expires.

All options have expiration dates. It could be a matter of weeks, months or up to three years, in the case of certain options called Long-Term Equity Anticipation Securities (LEAPS) – more on this later.

If you don’t exercise your right within that given time, the option expires worthless.

Options trade on the Chicago Board Options Exchange (CBOE), American Stock Exchange (AMEX), New York Stock Exchange (NYSE) and Chicago Board of Trade (CBOT).

Most of the activity takes place on the CBOE and the AMEX.

But that is not something you have to concern yourself with.

When you place a trade with your brokerage firm, it will search the exchanges for the best price.

The important thing for you to understand is that options are traded just like stocks – in the sense that they have a symbol.

Options prices can be tracked online on a number of websites, including Yahoo Finance and BigCharts.com.

How Do Options Work?

Options are directly related to their underlying security – be it a stock, index, commodities future, etc.

For example, you could choose to simply buy 500 shares in Company XYZ, which is currently trading for around $10 a share.

Excluding commissions, that would cost you $5,000. However, you might not want to buy 500 shares.

So rather than buying 500 shares of stock, you can instead choose to buy five call options – and “control” those same 500 shares – for significantly less.

Remember, owning five call options gives you the right to buy those same 500 shares at a certain price at a certain time.

(Remember, if you think a stock is going to rise, you’d buy calls. If you think a stock is headed for a decline, you’d buy puts).

Next, you need to pick a time frame for your scenario to play out – the end of which is known as an expiration date.

This, as mentioned, can be anything from weeks to months to years.

Options prices vary depending on their expiration date, strike price and the volatility of the market.

Once you’ve done that, you’re ready to make your trade!

So here’s the conversation that basically takes place every single time you place an options trade…

When you buy an option, it is as though someone is saying to you…

“I will allow you to buy or sell 100 shares of this company’s stock at a specified price per share – anytime between now and the expiration date. But for that right, I expect you to pay me a fee.”

This is essentially the no-nonsense conversation that takes place with every options trade you make.

That fee you pay is called the premium, which will vary considerably depending on the exercise price and time until expiration, as well as the stock’s volatility.

And that leads into Winning Strategy No. 3…

Winning Strategy No. 3: How the Market Makers (aka Floor Traders) Get You to Overpay (and How to Beat Them at Their Own Game)

The Bid, the Ask and the Spread

Two of the most important parts of options trading are knowing what an option should sell for and getting it for what it’s worth. This requires knowledge of the bid, the ask and the spread.

❖ The bid price is what floor traders are willing to buy the option for.

❖ The ask price is what floor traders are willing to sell the option for.

❖ The spread is simply the difference between the bid and the ask price.

That difference is how floor traders make their money.

They buy 100 options for $1 – and then they sell those same 100 options for $1.20, and they pocket the spread (in this case, $20, 100x over, which amounts to $2,000). All. Day. Long.

For example, shares in ABC Inc. are trading at $15.50. You want to buy July call options, and you see this:

Bid: $0.40 Ask: $0.55 Last trade: $0.55

Here’s why 90% of options lose money…

A rookie trader looks at those numbers and immediately dives in and pays the ask price – which means they pay $0.55 for this option. But since this option is really worth only the bid price (which is what the floor traders are willing to buy it for), the rookie trader is already down 38% before they’ve even started.

TIP: When a market maker sees you buying options at market price, they know they can take your money. They’ll buy this option for $0.40– and then turn around and immediately sell it to you for $0.55 – all day long. But here’s how to beat them: Use limit orders.

These allow you to place trades between the bid and ask. It’s the only way you can put some pressure on the market makers, tempting them to alter the price and bring the spread to a more reasonable level.

Never buy an option at the ask price – or with a market order. Use a limit order that falls between the bid and the ask. Take your time. If the underlying shares do not move, the option price will fall. If you can, place your order at the bid price. If the option is liquid, you could get filled – and take back the advantage that the floor trader is trying to get from you. With this tip, you can beat them at their own game!

Winning Strategy No. 4: The Simplest Way to Know If an Option Is Priced Fairly – or Overvalued

For this tip, we’ll discuss the two components that make up an option’s premium…

Intrinsic Value and Extrinsic Value (aka “Time Value”)

When executing an options trade, it’s critical to understand what factors affect the price of any given option. That’s where intrinsic value and time value come into play…

An option has two sources of value. The cost (or premium) of any given option is based on its intrinsic value and its time value.

Intrinsic value refers to the portion of the option premium that is in the money.

Any additional value beyond that is considered time value.

For example: A call option has a current premium of $3 ($300) and a strike price of $45. At the time you buy the call, if the underlying stock’s market value is $46 per share, then we say the following about its intrinsic value, as well as its time value.

First, this option has one point of intrinsic value. In other words, it’s $1 in the money, or above the strike price. (You’re buying the right to buy 100 shares of a $46 stock for $45 per share. So $46 – $45 = $1 of intrinsic value.)

That leaves $2 of the option’s cost in extrinsic value – aka time value. (The $3 premium cost of the option – the intrinsic value of $1 = $2 worth of time value.)

Even if the stock’s value stays the same, leaving the intrinsic value at $1, as the stock approaches expiration, its time value shrinks – leading to a decrease in the total amount of the premium. At expiration, the time value will equal zero, leaving the premium value equal to the intrinsic value (in this case, $1).

All options act the same when it comes to intrinsic value. All options that are in the money (i.e., the strike price of the option is less than the stock’s current value) will reflect that value. If an option is in the money by $5 (say the option is at a $35 strike and the current price is $40), then the option premium will be at least $5. If the option moves $10 into the money, then the option premium will be at least $10.

Conversely, if the stock declines and the option moves out of the money (for example, if the strike price is at $45 and the stock is at $44), then the intrinsic value goes to zero and the premium would reflect only time value.

When it comes to determining the time value, a number of factors come into play.

Obviously, the amount of time left until expiration is important, but so is the volatility of the underlying stock. A host of other factors affect time value, such as the perception of value by other investors, the stock’s price history, the company’s fundamental and technical indicators, the industry of the company, upcoming earnings announcements or news items, etc.

That means two companies – both priced at $55 per share, both with strike prices of $50 and both with identical time frames until expiration – can have different premium prices.

For instance, a fast-moving company like Netflix or Tesla will carry a higher premium than a slower-moving company like Pfizer or Eli Lilly.

Volatility (aka “Vol”) in the World of Traders

Volatility has a direct effect on the price of an option.

When a stock is fluctuating wildly, that means the stock is volatile, which in turn increases the volatility premium of the option.

Simply put: When a stock make big moves, traders want to get paid more to sell you options on that fast-moving stock.

Why? Because it’s risker for them.

Buying a volatile stock is like selling homeowner’s insurance for a house in California sitting on an oceanside cliff.

Will that policy be more expensive or less expensive than the policy for a suburban house in Middle America that’s valued exactly the same?

Well, the California house on the cliff will have significantly higher premiums, right? Of course it will, simply because the risk to insure a house sitting on a cliff overlooking the Pacific Ocean is far greater than insuring a house on flat, stable land in the suburbs of Chicago.

The same logic applies to pricing options volatility.

When volatility increases, so do options prices.

When stocks are stagnant, volatility decreases, which in turn brings down the options premiums.

There are two types of volatility that relate to options trading:

❖ Historical volatility measures how erratic, or volatile, the stock has been in the past.

❖ Implied volatility is a forward-looking calculation that makes an assessment of how erratic, or volatile, the stock might be in the future.

Some traders like to use 10-day, 30-day or 50-day historical volatility when pricing options, while others like to use the current implied volatility.

But you shouldn’t be overly concerned with how volatility is calculated or which measure is used. Just use intrinsic and extrinsic value calculations to get a sense of pricing – and you’ll instantly know if an option is expensive or not.

TIP: The simplest way to know if an option is priced fairly – or overvalued – is to calculate the intrinsic value first and then compare that with the total premium. If it’s more than double, then the option is overvalued (in our opinion) – or very volatile. Either way, you’ll have a good sense of the pricing before making a trading decision.

Ideally, you want to buy when volatility is low – because options prices will be lower – but also when you are soon expecting an increase in volatility… which will increase prices. That’s the name of the game, and playing it is an art form. Master this and you’ll become an insanely profitable options trader.

Winning Strategy No. 5: The Very Best Way to Take Profits

And Now, the Trading Part Begins!

So now that you know how to open an options trade, what can you do with it once it is open? Fortunately, it’s pretty straightforward and there are a couple of choices.

First of all, if you’ve bought a call option, you are not obligated to buy the 100 shares of stock (in each contract) if the strike price is hit.

Conversely, simply because you bought a put option, that doesn’t mean you have to sell those shares if your price is hit.

Remember that an option is a right, not an obligation.

In fact, the vast majority of call buyers never end up buying the underlying stock. And the vast majority of put buyers never end up selling the underlying stock.

Yes, you can always exercise the call option and buy the stock at the agreed-upon strike price. At that point, you could immediately turn around and sell it.

But if you don’t want to own the stock, you can sell your options back onto the open market for a profit. If the underlying stock has gone up to $10 above the strike price, then each option is worth at least $10 (the intrinsic value). This amount could even be more with the time value added in. Let’s say that with the time value, the option climbs to $12. The difference between what you paid for the call and the current $12 is your profit.

What to Do if Your Call Goes Down (Not Profitable)

Let’s assume you’ve bought an XYZ Inc. January $40 call option for $1 and it goes the wrong way for you. The market value of XYZ Inc. either does not change or declines in value, and your alternatives begin to narrow. Let’s say it gets to the end of November and XYZ is currently trading at only $36. Here are your alternatives:

Your first choice is to sell the call while it still has time value left. You would receive less than you paid for the option, due to the stock still being $4 out of the money and the option having less than two months until expiration (leaving less time for the stock to achieve the price objective). The option would, let’s say, be selling for about $0.50. You would sell the XYZ option for $0.50 and take a loss of $50 ($100 minus $50).

Or you can hold on and hope that XYZ shares go up and the option increases in value prior to its expiration, allowing you to recoup your costs or even make a profit. However, if XYZ does not increase in value and fails to reach your strike price before expiration, that option will expire worthless.

What to Do if Your Put Goes Down (Profitable)

Conversely, if you had purchased a put option, you’d be expecting the stock’s value to fall.

Let’s say XYZ shares are trading at $34. You buy the January $30 puts at a cost (premium) of $1.05. If the price of XYZ goes the right way for you and the stock’s price falls to $20 ($10 under your $30 strike price), then you can do the following.

TIP: Sell the put before it expires. With the option $10 in the money, the put option that cost you $1.05 is now worth at least $10 (the intrinsic value of the option without any time value figured in). An intrinsic value of $10 means you have made at least an $8.95 profit. This is how we trade. This is the very best way to take options profits. Simply sell the options contracts back to the market makers – and collect your profit.

Remember that as a call buyer or put buyer, you are not obligated to buy or sell 100 shares just by virtue of owning the call or put option. That’s why they’re called options – not obligations.

Risks Associated With Options – and How They Can Work for You

Options are like burning matches: They will all extinguish themselves eventually. For most investors, the thought of putting money in an investment that literally evaporates after the passing of a deadline, or one that will decline just because time goes by, is enough to make them run in the opposite direction.

And because options expire, they are very different from owning the shares of a company outright. If you own shares of a company outright or are selling the shares short, the time frame of your ownership can be indefinite. Not so with options. With options, not only do you have to be right about the direction of the underlying stock, the movement also has to take place within a specified time frame. On a positive note, your loss with an option is limited to the amount of your investment. Because an option is a right and not an obligation to purchase or sell shares, you are never required to take action on an option you have purchased.

Viewed in this light, options investing allows you a sense of risk reduction for your investment. For example, let’s say that in March you purchased a July $45 call option on Company XYZ with a premium cost of $2 and the stock trading at $40. If, by July, XYZ drops to $20, investors who purchased 100 shares will have lost a total of $2,000. But those who purchased the option contract will be out only $200 (the cost of the option). That’s quite a difference.

Options Leverage: Getting the Most Bang for Your Buck

Leverage is crudely defined as “using a little money to make a lot.” But we’ll use a more conventional definition: “putting down a small investment to control a large

amount of stock.”

And as you’ll see, that’s exactly what an option does.

Let’s take XYZ Inc. again as an example and assume it is trading for $95 currently. A $5 premium on an XYZ $95 strike call option will let you control 100 shares of a $95 stock. One option controlling 100 shares would cost you $500. However, if you bought 100 shares of the underlying stock, that would cost you $9,500. That’s a $9,000 difference.

So in reality, you are putting only 5.3% down. In terms of your profit potential, this also means that you could double or triple your investment with just a five- or 10-point move in the stock.

That’s what’s called getting the most bang for your buck.